Irs depreciation calculator

1 in-depth understanding of the types and amounts of qualifying short-life assets 2 statistical. The calculator makes this calculation of course Asset Being Depreciated -.

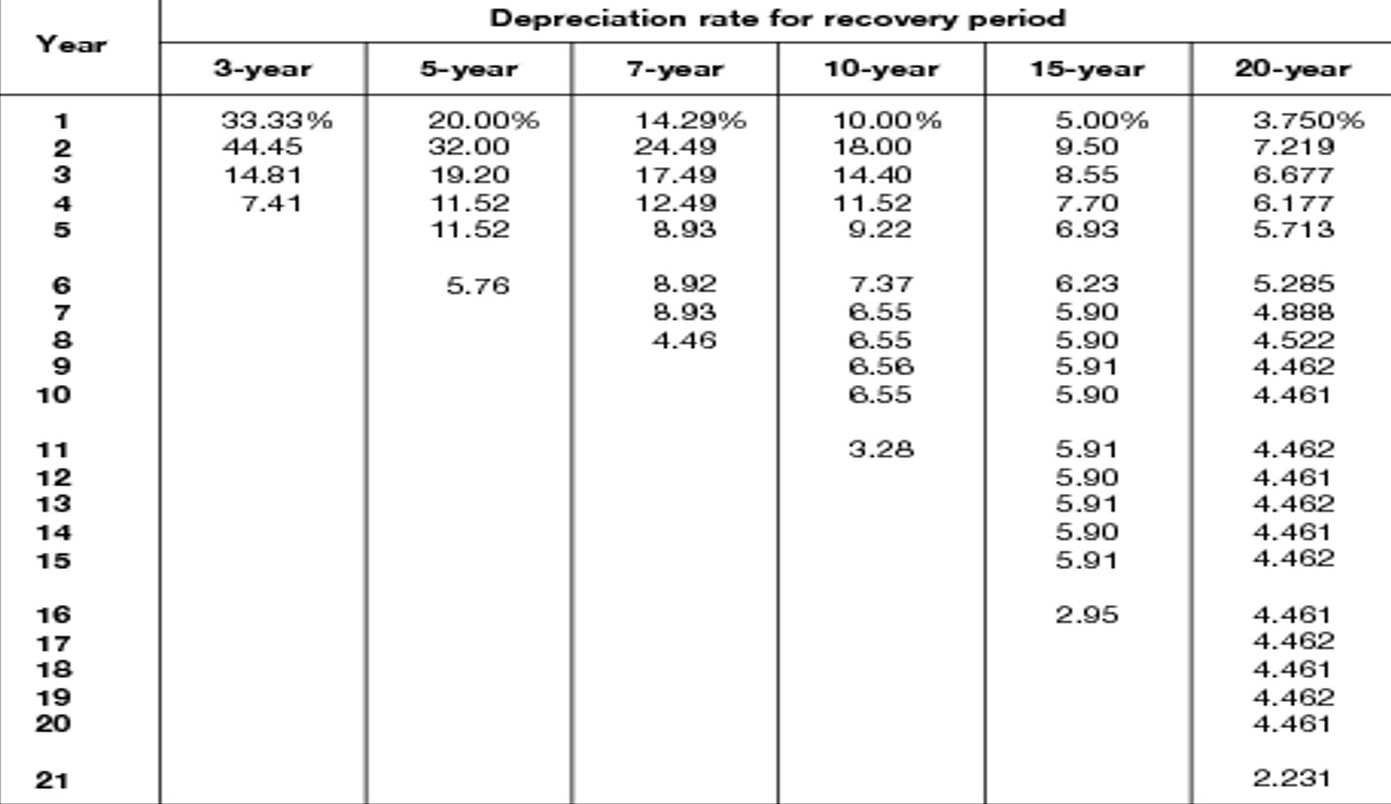

The Mathematics Of Macrs Depreciation

Tax depreciation is the depreciation expense claimed by a taxpayer on a tax return to compensate for the loss in the value of the tangible assets used in income-generating.

. Di C Ri Where. Next youll divide each years digit by the sum. Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens.

You have nonresident alien status. The IRS addressed a quirky interaction of bonus depreciation under IRC 168k and the luxury auto rules under IRC 280F in Revenue Procedure 2019-13. The MACRS Depreciation Calculator uses the following basic formula.

1 Cost of Equipment. D i C R i Where Di is the depreciation in year i C is the original purchase price or basis of an asset Ri is the depreciation. The bonus depreciation calculator is proprietary software based on three primary components.

Depreciation recapture tax rates. Ad Get Access to Expert Tax Depreciation Solutions to Make the Complex Simple. 2022 IRS Section 179 Calculator - Depreciation Calculator - Ascentium Capital Section 179 Calculator Leveraging Section 179 of the IRS tax code could be the best financial decision you.

Di indicates the depreciation in year i C indicates the original purchase price or. It provides a couple different methods of depreciation. Absent this safe harbor method.

It is not intended to be used. You generally cant deduct in one year the entire cost of property you acquired produced or improved and placed in service for use either in your trade or business. Depreciation is one of the expenses youll include on Schedule E so the depreciation amount effectively reduces your tax liability for the year.

1 in-depth understanding of the types and amounts of qualifying short-life assets 2. 7 6 5 4 3 2 1 28. The MACRS Depreciation Calculator uses the following basic formula.

The first step to figuring out the depreciation rate is to add up all the digits in the number seven. If you enter 100000 for basis and business use is 80 then the basis for depreciation adjusted basis is 80000. This depreciation calculator is for calculating the depreciation schedule of an asset.

Depreciation Calculator Per the IRS you are allowed an annual tax deduction for the wear and tear of property over the course of time known as The gradual reduction in value of an asset. Our macrs depreciation calculator uses the given macrs formula to perform macrs calcualtion. Since depreciation recapture is taxed as ordinary income as opposed to capital gains your depreciation recapture tax rate is going to be your.

First one can choose the straight line method of. Expertly Manage the Largest Expenditure on the Balance Sheet with Efficiency Confidence. Also includes a specialized real estate property calculator.

In other words the. This Depreciation Calculator spreadsheet was designed to demonstrate how to perform various depreciation calculations for a variety of depreciation methods. Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules.

Estimate your tax withholding with the new Form W-4P.

Free Modified Accelerated Cost Recovery System Macrs Depreciation

Automobile And Taxi Depreciation Calculation Depreciation Guru

Solved Depreciation Rate For Recovery Period Year 3 Year Chegg Com

Guide To The Macrs Depreciation Method Chamber Of Commerce

Macrs Depreciation Definition Calculation Top 4 Methods

Excel Finance Class 85 Macrs Depreciation Asset Sale Impacts On Npv Cash Flows Youtube

Free Macrs Depreciation Calculator For Excel

Macrs Depreciation Calculator Table Calculator Table Guide Fixed Asset

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Macrs Depreciation Calculator With Formula Nerd Counter

Macrs Depreciation Calculator Straight Line Double Declining

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Depreciation Macrs Youtube

Depreciation Schedule Template For Straight Line And Declining Balance

Double Teaming In Excel

Depreciation Accounting Macrs Depreciation Modified Accelerated Cost Recovery System Youtube

Macrs Depreciation Definition Calculation Top 4 Methods